Faculty

Ryuichiro Izumi, Assistant Professor of Economics, Wesleyan University

Ryuichiro Izumi is Assistant Professor of Economics at Wesleyan University, where he teaches courses in macroeconomics, money and banking, and investment finance. Much of his work focuses on the causes and amplification mechanisms of banking crises, especially how public policy can promote, or inadvertently undermine, financial stability. Recent work examines the implications of the 2023 banking turmoil and explores emerging issues in the financial system, including instant payment systems, digital currencies, and the intersection of finance and climate change. Website: https://www.ryuichiroizumi.com/

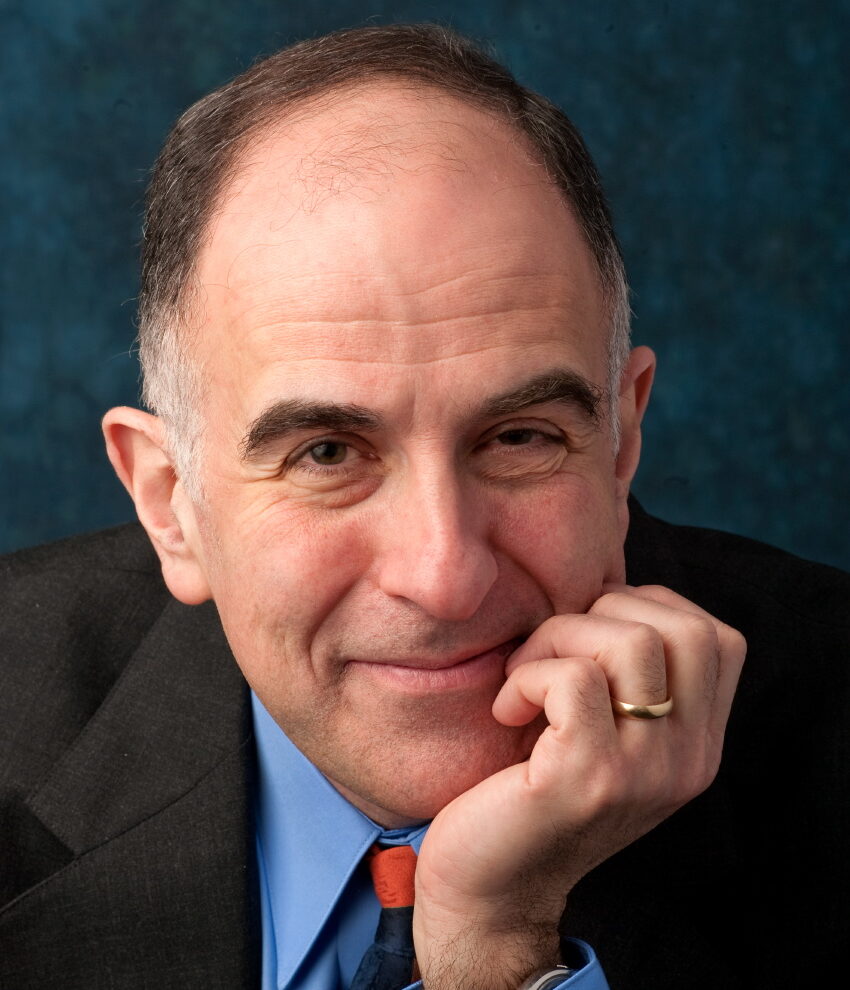

Richard S. Grossman, Andrews Professor of Economics, Wesleyan University

Richard S. Grossman is Andrews Professor of Economics at Wesleyan University and a Visiting Scholar at the Institute for Quantitative Social Science at Harvard University. He graduated magna cum laude from Harvard College, holds an M.Sc.Econ. degree in Economic History from the London School of Economics and Political Science of the University of London, and A.M. and Ph.D. degrees in Economics from Harvard University. He is the author of Unsettled Account: The Evolution of Banking in the Industrialized World since 1800 (Princeton University Press, 2010) and WRONG: Nine Economic Policy Disasters and What We Can Learn from Them (Oxford University Press, 2013). He teaches classes in American and European Economic History, Macroeconomics, and Money and Banking. Website: https://rgrossman.faculty.wesleyan.edu/

Masami Imai, John E. Andrus Professor of Economics, Wesleyan University

Masami Imai is Professor of Economics and East Asian Studies at Wesleyan University. He received his Ph.D. in Economics from the University of California, Davis. His research focuses on banking and financial intermediation, with publications in leading journals such as AEJ: Macroeconomics, Journal of Banking and Finance, and Journal of Money, Credit, and Banking. He teaches courses in macroeconomics, money and banking, and the economies of Japan and East Asia. Website: https://mimai.faculty.wesleyan.edu/

Emmanuel Kaparakis, Director, Center for Advanced Computing and Hazel Quantitative Analysis Center, Wesleyan University

Manolis did his undergraduate work in Athens, Greece and his graduate work in Economics at the University of Connecticut. He is the director of Wesleyan’s Hazel Quantitative Analysis Center. His research focus is on the efficiency of financial institutions.

Students

Kaustubh Vasudevan (’26), student leader

Economics and Mathematics Major, Global South Asian Studies Minor

Research interest: Banking Fragility Mechanisms

Kaustubh joins as a FiLab Leader in Fall 2025, leveraging insights from ECON 333 and prior internship experience across Private Equity and Investment Banking. Outside the classroom, Kaustubh enjoys playing tennis, running, and the piano.

Tyler Asher (’26)

Economics Major, Data Analysis Minor

Research Interest: Banking Fragility and Regulation

Tyler joined the Fall 2025 lab after working as a hedge fund analyst over the summer. Outside of school and work, Tyler enjoys climbing, DJing, and reading.

Ana de Souza Silva Cruz (’26)

Economics Major and Data Analysis Minor

Research interest: The role of cryptocurrencies in developing economies

Ana joins the lab after completing her internship with the Wesleyan Investment Office. Outside of class Ana enjoys playing volleyball, playing board games and spending time with friends.

Kevin He (’26)

Economics and English Major

Research interest: Systemic Risk in DeFi Lending Protocols

Kevin is an Economics and English double major researching systemic risk in DeFi lending protocols. After working as a software engineer in a DevOps role this past summer, he spends his free time playing volleyball, hiking, rock climbing, and cooking.

Wesley Tan (’26)

Economics and Computer Science Major

Research Interests: Decentralized finance, stablecoins, liquidity and finance.

Wesley is a senior studying Computer Science and Economics, joining the lab in Fall 2025. He is passionate about blockchain technology and how this can be applied to economics, having worked on validator metrics at a blockchain consulting firm. Wesley enjoys tutoring and playing the piano; Rachmaninoff and Ravel are among his favorite composers.

Anthony Ganci (’28)

Economics and Mathematics Major, Data Analysis Minor

Research Interest: Centralized Finance’s Risk Exposure to DeFi, Impact of Corporate-Issued stablecoins on Operations and Risk Tolerance

Anthony joins the lab in the Fall of 2025 following his work the previous summer for the Quantitative Analysis Center Apprenticeship. On campus, Anthony is an orientation leader, international student buddy, and a member of both Wesleyan Investment Group and Foss Hill Financial. In his free time, he enjoys biking, skiing, playing squash, and spending time with family and friends.